India’s energy relationship with Russia has fundamentally transformed since the Ukraine conflict began in February 2022, evolving from a marginal trade partnership into one of the most significant bilateral energy relationships globally. This comprehensive analysis examines the substantial benefits India has derived from Russian oil imports and the potentially severe economic consequences of banning this critical energy source.

Russia has emerged as India’s largest crude oil supplier, accounting for approximately 35% of the country’s total oil imports in 2024-25, a dramatic increase from less than 2% before the Ukraine war. This strategic shift has enabled India to achieve significant cost savings while maintaining energy security for its 1.4 billion citizens. However, mounting Western pressure through sanctions threats and trade restrictions poses substantial risks to this beneficial arrangement.

India’s Energy Security Landscape

Critical Import Dependency

India’s energy security challenges are profound and growing. The country’s crude oil import dependency has reached a record high of 88.2% in fiscal year 2025, up from 87.4% in the previous year. As the world’s third-largest oil importer and consumer, India imports over 4.6 million barrels per day to meet its rising energy demands driven by robust economic growth, urbanization, and industrial expansion.

The country’s domestic crude oil production has been declining consistently, dropping from 36 million tonnes in FY2017 to 28.7 million tonnes in FY2025, representing an annual decline of approximately 3%. This declining domestic production coupled with rising consumption has made India increasingly vulnerable to global oil price fluctuations and supply disruptions.

India’s heavy reliance on oil imports makes its economy particularly sensitive to geopolitical tensions in key supply regions. Approximately 45% of India’s crude oil and 54% of its LNG imports pass through the strategically vulnerable Strait of Hormuz, which handles about 20% of global oil trade. Any disruption in this critical maritime chokepoint could severely impact India’s energy security.

Diversification Strategy

In response to these vulnerabilities, India has significantly diversified its oil import sources, expanding from 27 countries to approximately 40 countries currently. This diversification strategy has been crucial in reducing over-dependence on Middle Eastern suppliers and mitigating geopolitical risks. The emergence of new suppliers such as Guyana, combined with increased imports from Brazil, Canada, and the United States, has strengthened India’s energy security framework.

Substantial Benefits from Russian Oil Trade

Foreign Exchange Savings

The most quantifiable benefit of India’s Russian oil imports has been the massive foreign exchange savings achieved through discounted crude purchases. Indian refiners have saved at least $10.5 billion in foreign exchange between April 2022 and May 2024 by importing discounted Russian crude oil. These savings represent a significant contribution to India’s economic stability and balance of payments.

Breaking down these savings by fiscal year reveals the consistent nature of the benefits:

- FY2023: $4.87 billion in savings

- FY2024: $5.43 billion in savings

- 14-month period (April 2022-May 2023): $7.17 billion in savings

The discounts on Russian oil have been substantial, though they have narrowed over time. Initially, Russian crude was available at discounts of $8-10 per barrel compared to other suppliers, but these discounts have since reduced to $3-6 per barrel in 2025. Despite this reduction, the savings remain significant for India’s major refiners including Indian Oil Corporation, Reliance Industries, Bharat Petroleum Corporation, Hindustan Petroleum Corporation, and Nayara Energy.

Energy Security Enhancement

Russian oil imports have dramatically enhanced India’s energy security by providing a reliable alternative to Middle Eastern suppliers. The creation of the Eastern Maritime Corridor connecting Chennai to Vladivostok has reduced shipping time and costs, making Russian oil more economically viable than traditional suppliers.

The reliability of Russian supplies has been particularly valuable during periods of geopolitical tension in the Middle East. When regional conflicts threaten traditional supply routes, Russian oil provides a crucial buffer that helps maintain stable energy supplies for India’s growing economy.

Economic Stability and Price Control

The availability of discounted Russian oil has helped Indian refiners maintain stable domestic fuel prices despite global oil market volatility. This price stability has been crucial for controlling inflation and supporting economic growth, particularly benefiting India’s vast population that relies on affordable transportation fuels.

The cost savings from Russian oil imports have also provided Indian fuel retailers with the flexibility to avoid hiking petrol and diesel prices even during periods of high international oil price volatility. This has been particularly important for maintaining consumer purchasing power and supporting economic growth.

Refinery Profitability and Export Competitiveness

Indian refiners have benefited from enhanced profit margins by processing discounted Russian crude and exporting the refined products globally. Reliance Industries, operating the world’s largest refinery complex at Jamnagar, has been the biggest beneficiary of this arrangement, becoming India’s largest buyer of Russian oil.

The refining sector has capitalized on the price differentials by importing cheap Russian crude and selling refined products to international markets, including Europe. This has generated substantial export revenues and strengthened India’s position as a major global refining hub.

Strategic Autonomy

The Russian oil relationship has demonstrated India’s strategic autonomy in foreign policy, allowing the country to prioritize its national interests over external pressure. Despite criticism from Western nations, India has maintained its position that energy security is a paramount national priority that cannot be compromised for geopolitical considerations.

This strategic approach has earned respect from other developing nations and reinforced India’s position as a leader among emerging economies that refuse to be coerced into taking sides in global conflicts at the expense of their national interests.

Major Drawbacks and Risks of Banning Russian Oil

Severe Economic Consequences

Banning Russian oil imports would impose severe economic costs on India, potentially wiping out the $10.5 billion in savings achieved over the past two years. Oil Minister Hardeep Singh Puri has warned that excluding Russia’s 10% share of global oil production could drive crude prices to $120-130 per barrel, significantly increasing India’s import bill.

With Russia currently accounting for 35% of India’s total oil imports, finding alternative suppliers would likely result in higher costs. The replacement oil would need to be sourced from traditional suppliers in the Middle East, Africa, or the Americas at prevailing market rates, eliminating the cost advantages that Russian oil has provided.

Energy Security Vulnerabilities

Eliminating Russian oil would force India to increase its dependence on Middle Eastern suppliers, concentrated around the geopolitically volatile Persian Gulf region. This would increase India’s vulnerability to supply disruptions caused by regional conflicts, political instability, or deliberate supply restrictions by producer cartels.

The loss of Russian supplies would also reduce India’s negotiating leverage with other suppliers, potentially leading to less favorable contract terms and higher prices. The diversification strategy that has strengthened India’s energy security would be significantly weakened by the elimination of such a major supplier.

Threats to Export Revenues

India’s petroleum product exports, valued at $44.3 billion in FY2025, face significant risks from Western sanctions targeting Russian oil. The EU’s 18th sanctions package has imposed restrictions on refined petroleum products made from Russian crude oil and exported by third countries.

This threatens India’s $15 billion in petroleum product exports to the European Union, which represents a substantial portion of India’s refined product export revenue. Major Indian refiners like Reliance Industries and Nayara Energy, which have exported significant volumes of refined Russian crude to Europe, face potential exclusion from these lucrative markets.

Sanctions and Tariff Threats

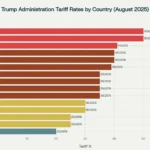

The United States has threatened to impose 500% tariffs on countries continuing to trade with Russia, specifically targeting India and China as major Russian oil buyers. Such tariffs would not only affect oil trade but could extend to all merchandise exports from India to the United States, severely impacting bilateral trade worth hundreds of billions of dollars.

NATO Secretary General Mark Rutte has echoed these threats, warning that countries like India could face severe sanctions if they continue purchasing Russian energy. These secondary sanctions could disrupt India’s access to Western financial systems, technology, and markets, imposing costs far beyond the energy sector.

Financial and Operational Disruptions

Continuing to import Russian oil under increasing sanctions pressure creates operational complexities for Indian refiners. Banks, insurers, and shipping companies may become reluctant to facilitate Russian oil transactions, increasing costs and creating supply chain uncertainties.

The EU’s sanctions on Nayara Energy, which operates a 20-million-tonne-per-year refinery in Gujarat with 49.13% ownership by Rosneft, demonstrate how Western sanctions can directly target Indian energy infrastructure. Such measures create uncertainty for investors and complicate long-term energy planning.

Diplomatic and Strategic Costs

Banning Russian oil imports would represent a significant diplomatic concession to Western pressure, potentially undermining India’s carefully cultivated strategic autonomy. This could set precedents for future situations where India’s national interests diverge from Western preferences.

The decision would also strain India’s historically strong relationship with Russia, a key strategic partner in defense, space technology, and other critical sectors. Russia has been a reliable partner during previous international crises, and alienating Moscow could have long-term strategic consequences.

Sector-Specific Impact Analysis

Refining Industry

India’s refining sector, with a total capacity of 256.8 MMTPA, has been significantly enhanced by access to discounted Russian crude. Major refiners have optimized their operations around Russian oil grades, particularly Urals crude, which accounts for approximately three-fourths of India’s Russian oil imports.

Reliance Industries, with its massive Jamnagar refinery complex, has become the world’s single biggest buyer of Urals crude, processing this oil into high-value refined products for export to global markets. The company has shipped an average of 2.83 million barrels of diesel and 1.5 million barrels of jet fuel per month to Europe in 2025, demonstrating the scale of operations built around Russian crude processing.

Nayara Energy, India’s second-largest single-site refinery with a capacity of 20 million metric tonnes annually, has been particularly dependent on Russian crude due to Rosneft’s ownership stake. The facility has developed specialized capabilities for processing Russian oil grades and has built extensive retail networks across India with nearly 7,000 fuel outlets.

Export Sector

India’s petroleum product exports have grown significantly, reaching 64.7 million tonnes in FY2025, with much of this growth attributed to the processing of discounted Russian crude. The country has emerged as a major supplier of refined products to Europe, with exports to the EU reaching $19.2 billion in FY2024.

The refining-for-export model has generated substantial foreign exchange earnings and positioned India as a crucial link in global energy supply chains. European countries, having reduced their direct imports of Russian crude, have increasingly relied on Indian refiners to process Russian oil and supply refined products.

However, this export model faces significant threats from evolving Western sanctions that target the Russian crude supply chain regardless of where processing occurs. The EU’s latest sanctions package specifically bans imports of refined petroleum products made from Russian crude and exported by third countries, directly threatening India’s export-oriented refining strategy.

Alternative Supply Scenarios and Costs

Traditional Supplier Options

If forced to replace Russian oil, India would likely need to increase imports from traditional Middle Eastern suppliers including Saudi Arabia, Iraq, UAE, and Kuwait. While these suppliers have adequate capacity, the oil would likely be priced at market rates without the significant discounts that have made Russian crude attractive.

Iraq, currently India’s second-largest supplier at 18.5% market share, could potentially increase supplies, but this would require expanded production capacity and transportation infrastructure. Similarly, Saudi Arabia and the UAE could increase their market shares, but at higher prices that would significantly increase India’s import costs.

Emerging Suppliers

India has been exploring new suppliers including Brazil, Guyana, and Canada to diversify its energy sources. U.S. crude imports have already increased by more than 50% in the first half of 2025, while Brazilian shipments grew 80% year-on-year, demonstrating the potential for supply diversification.

However, these alternative suppliers cannot immediately replace the scale of Russian imports, and their oil would likely be priced higher than discounted Russian crude. The logistics of establishing new supply chains, including shipping routes and storage infrastructure, would also require time and investment.

Strategic Petroleum Reserves

India is expanding its strategic petroleum reserves to enhance energy security, with plans for three new reserves at Bikaner, Mangalore, and Bina in addition to existing facilities. These reserves, once completed, will provide approximately 90 days of oil consumption coverage, meeting international energy security standards.

While strategic reserves provide short-term supply security during disruptions, they cannot address the long-term economic costs of replacing discounted Russian crude with more expensive alternatives. The reserves are designed for emergency situations rather than routine supply management.

Global Market Implications

Price Impact

Oil Minister Hardeep Singh Puri has argued that India’s purchases of Russian oil have helped stabilize global energy markets by preventing oil prices from reaching $120-130 per barrel. By absorbing Russian crude that Western sanctions had displaced from traditional markets, India has helped maintain global supply-demand balance.

The elimination of Russian oil from global markets would create a supply shortage equivalent to approximately 9 million barrels per day, representing about 10% of global production. This would force the world to either reduce consumption by 10% or compete more intensively for remaining supplies, driving prices significantly higher.

Market Rebalancing

India’s role in processing Russian crude and exporting refined products has created a complex global energy flow that helps Western countries indirectly access Russian energy while maintaining the facade of sanctions compliance. This arrangement has allowed European countries to meet their energy needs while technically adhering to sanctions against direct Russian crude imports.

The disruption of this system through expanded sanctions or Indian policy changes would force a major rebalancing of global energy flows, likely resulting in higher prices for consumers worldwide and potential shortages in key markets.

Geopolitical Considerations

Strategic Autonomy vs. Western Alignment

India’s approach to Russian oil imports reflects its broader foreign policy strategy of maintaining strategic autonomy while building partnerships with multiple powers. The country has consistently rejected unilateral sanctions and emphasized its right to pursue energy security through legitimate commercial arrangements.

This position has sometimes created tensions with Western partners who view Indian oil purchases as indirectly supporting Russia’s war effort in Ukraine. However, India has countered this criticism by pointing out continued European imports of Russian gas and the West’s selective application of sanctions.

Regional Leadership

India’s firm stance on energy security has positioned the country as a leader among developing nations that refuse to sacrifice their economic interests for Western geopolitical objectives. This leadership role has strengthened India’s position in forums like BRICS, the Shanghai Cooperation Organization, and the Global South coalition.

The country’s success in maintaining beneficial economic relationships despite Western pressure has inspired other developing nations to pursue similar strategies of strategic autonomy and economic pragmatism.

Diplomatic Balance

India has sought to maintain diplomatic balance by supporting humanitarian assistance to Ukraine while continuing energy trade with Russia. Prime Minister Narendra Modi has emphasized that solutions to the Ukraine conflict cannot be found on battlefields and has advocated for dialogue and diplomacy.

This balanced approach has allowed India to maintain relationships with both sides while prioritizing its national interests. However, escalating Western pressure and the expanding scope of sanctions may make this balancing act increasingly difficult to maintain.

Economic Modeling and Future Projections

Cost-Benefit Analysis

Economic analysis suggests that the benefits of Russian oil imports significantly outweigh the risks for India in the short to medium term. The $10.5 billion in foreign exchange savings achieved over two years represents substantial value that would be difficult to replace through alternative arrangements.

The cost of replacing Russian oil with alternatives could increase India’s annual oil import bill by $15-20 billion, assuming oil prices remain stable and alternative suppliers don’t exploit India’s constrained position by charging premium prices. This would represent a significant burden on India’s balance of payments and could contribute to inflationary pressures.

Growth Impact

India’s petroleum consumption is projected to reach 252.9 million tonnes in FY2026, reflecting continued strong demand growth. The availability of discounted Russian oil has helped manage the costs of this growing consumption, supporting economic growth and development.

Eliminating access to discounted Russian crude could constrain economic growth by increasing energy costs for industry and consumers. Higher fuel prices would have cascading effects throughout the economy, potentially reducing competitiveness and slowing the pace of economic development.

Infrastructure Implications

India’s refining infrastructure has been optimized around current supply patterns, including significant Russian crude processing capabilities. The sudden elimination of Russian supplies would require costly adjustments to refinery configurations and supply chain arrangements.

The investment required to establish alternative supply chains, modify refining capabilities, and develop new storage infrastructure could amount to billions of dollars and take several years to implement effectively.

Industry Perspectives and Stakeholder Views

Refining Sector Views

Indian refiners have generally supported continued Russian oil imports, viewing them as essential for maintaining competitiveness in global markets. The availability of discounted crude has enabled Indian refiners to offer competitive prices for refined products while maintaining healthy profit margins.

Industry executives have expressed concern about the potential impact of Western sanctions on their operations, particularly regarding access to shipping, insurance, and financial services. However, they have also demonstrated confidence in their ability to navigate sanctions through careful compliance and alternative arrangements.

Government Position

The Indian government has consistently defended Russian oil imports as legitimate commercial transactions essential for energy security. Officials have emphasized that India’s primary responsibility is to ensure affordable energy for its 1.4 billion citizens, regardless of Western political preferences.

Government statements have repeatedly stressed that India does not recognize unilateral sanctions and will continue to pursue energy security through all available legitimate means. This position has been consistently maintained despite mounting Western pressure and sanctions threats.

Consumer Impact

Indian consumers have benefited significantly from stable fuel prices enabled by discounted Russian crude imports. The government’s ability to avoid fuel price increases during periods of global oil market volatility has been crucial for maintaining consumer welfare and economic stability.

The elimination of Russian oil discounts could force significant increases in domestic fuel prices, affecting transportation costs, inflation, and overall economic conditions. This would particularly impact lower-income households that spend a larger proportion of their income on energy.

Comparative International Analysis

Chinese Approach

China, as the world’s largest crude oil importer, has also increased its purchases of Russian oil, accounting for approximately 47% of Russia’s crude exports compared to India’s 37%. However, China’s approach has been more cautious, with greater emphasis on payment arrangements that circumvent Western financial systems.

China’s larger domestic market and different geopolitical relationships have provided it with more flexibility in managing Western pressure while maintaining Russian energy imports. Beijing’s approach offers lessons for India in terms of risk management and sanctions navigation.

European Response

European countries have formally banned Russian crude imports while continuing to import Russian LNG and purchasing refined products made from Russian crude through third countries like India. This selective approach has created opportunities for Indian refiners while highlighting Western inconsistencies in sanctions implementation.

The EU’s evolving sanctions framework, including restrictions on Russian crude refined in third countries, represents an attempt to close these loopholes while managing the economic costs of complete energy disconnection from Russia.

Risk Assessment and Mitigation Strategies

Short-term Risks

The immediate risks to India’s Russian oil trade include expanded Western sanctions, banking restrictions, and shipping complications. The recent EU sanctions on Nayara Energy demonstrate how quickly the sanctions landscape can evolve to target Indian interests directly.

Financial institutions and service providers may become increasingly reluctant to facilitate Russian oil transactions, creating operational challenges even for legitimate trade. Indian companies may need to develop alternative financial arrangements and service providers to maintain supply chain continuity.

Long-term Strategic Risks

The long-term risks include permanent damage to relationships with Western partners, exclusion from global financial systems, and restrictions on technology transfers. These consequences could extend far beyond the energy sector to affect India’s broader economic development and strategic partnerships.

However, India’s growing economic importance and strategic partnerships with multiple powers provide some protection against the most severe sanctions. The country’s large domestic market and economic growth prospects make it costly for Western nations to completely isolate India.

Mitigation Options

India has several options for mitigating risks while maintaining the benefits of Russian oil imports. These include developing alternative payment systems, expanding trade in national currencies, and building sanctions-compliant supply chains.

The country can also leverage its relationships with other major economies to build coalitions that resist unilateral sanctions and promote alternative global trade arrangements. The development of BRICS payment systems and trade mechanisms offers potential alternatives to Western-dominated financial infrastructure.

Future Scenarios and Strategic Recommendations

Scenario 1: Continued Trade Under Pressure

If India maintains Russian oil imports while managing Western pressure, the country would need to develop sophisticated compliance mechanisms and alternative service providers. This scenario offers the best economic outcomes but requires careful navigation of evolving sanctions.

Success in this scenario would require strong diplomatic engagement, robust legal compliance systems, and alternative financial arrangements. India would need to balance the economic benefits against the increasing political and operational costs.

Scenario 2: Gradual Diversification

A gradual reduction in Russian oil dependence while developing alternative suppliers offers a middle path that manages both economic and political risks. This approach would provide time to develop alternative supply chains while maintaining some benefits from Russian trade.

This scenario would require careful management of the transition to avoid supply disruptions or excessive cost increases. Success would depend on the availability of alternative suppliers and the pace of Western sanctions expansion.

Scenario 3: Complete Elimination

Completely eliminating Russian oil imports would address Western political concerns but at significant economic cost. This scenario would require substantial investment in alternative supply arrangements and would likely result in higher energy costs for Indian consumers and industry.

The success of this scenario would depend on India’s ability to secure favorable terms with alternative suppliers and manage the economic adjustment costs. Strong Western support, including preferential access to alternative supplies, would be essential for making this scenario viable.

Conclusion and Strategic Assessment

India’s Russian oil trade represents one of the most significant bilateral energy relationships in the contemporary global economy, generating substantial economic benefits while creating complex geopolitical challenges. The relationship has enabled India to save over $10.5 billion in foreign exchange while strengthening energy security through supply diversification.

The benefits of this relationship extend beyond immediate cost savings to include enhanced strategic autonomy, improved refinery competitiveness, and reduced dependence on geopolitically volatile supply regions. These advantages have supported India’s economic growth and development while demonstrating the country’s capacity for independent decision-making in international affairs.

However, the potential consequences of banning Russian oil imports would be severe and multifaceted. Economic costs could exceed $15-20 billion annually, while energy security would be compromised through increased dependence on Middle Eastern suppliers. The broader implications include diplomatic tensions, sanctions risks, and potential disruption of India’s energy-intensive development model.

The optimal strategy for India appears to involve careful risk management while maintaining the benefits of Russian energy trade. This requires sophisticated compliance mechanisms, alternative financial arrangements, and strong diplomatic engagement with all stakeholders. The country’s growing economic importance and strategic partnerships provide leverage for managing Western pressure while preserving essential economic interests.

Ultimately, India’s approach to this challenge will serve as a test case for emerging economies seeking to maintain strategic autonomy in an increasingly polarized global environment. The outcome will have implications not only for India’s energy security and economic development but also for the broader evolution of the international economic order and the principle of national sovereignty in economic decision-making.

The complexity of this issue demands nuanced policy responses that balance economic realities with geopolitical considerations while prioritizing the fundamental national interest of ensuring affordable, reliable energy for India’s growing economy and population. Success in this endeavor will require sustained political commitment, diplomatic skill, and economic adaptability as the global energy landscape continues to evolve.