President Donald Trump has implemented Trump Tariffs 2025, the most extensive tariff in nearly a century, with average U.S. import duties reaching 17.3% as of August 2025—the highest since 1935. These “reciprocal” tariffs, affecting over 90 countries, are generating unprecedented revenue of $30-50 billion monthly while simultaneously raising global recession risks to 40%.

Current Tariff Structure

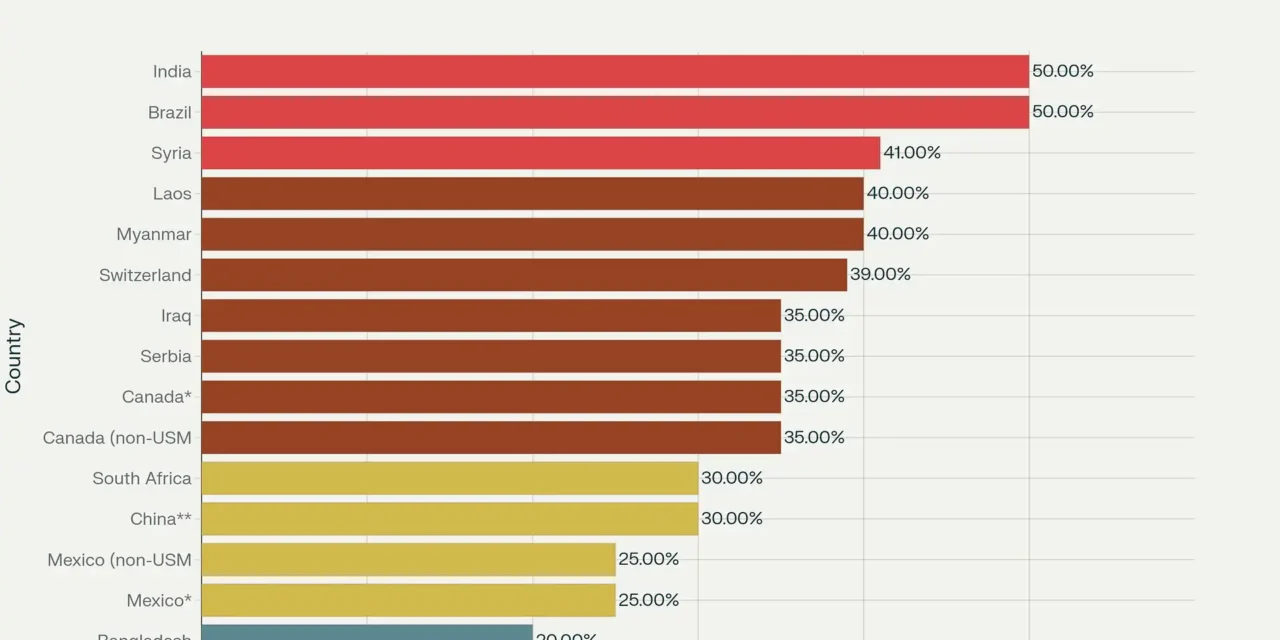

Tariff Rates by Country

The new tariff system imposes varying rates based on bilateral trade relationships and geopolitical considerations:

| Tariff Tier | Rate Range | Key Countries | Rationale |

|---|---|---|---|

| Highest | 50% | India, Brazil | Russian oil purchases (India), highest globally |

| Very High | 35-41% | Syria, Myanmar, Iraq, Switzerland | Conflict zones, strategic pressure |

| High | 25-30% | Canada (non-USMCA), China, South Africa | Trade rebalancing, resource dependencies |

| Moderate | 15-20% | Taiwan, Vietnam, Bangladesh, Pakistan | Manufacturing hubs, textile exporters |

| Negotiated | 10-15% | EU, Japan, South Korea, UK | Trade deal frameworks, strategic allies |

Special Cases and Exemptions

India faces the steepest penalties with a total 50% tariff rate—25% baseline plus an additional 25% penalty for continued Russian oil purchases. This makes India, alongside Brazil, subject to the highest tariff rates globally.

USMCA-compliant goods from Canada and Mexico remain exempt, though non-compliant items face 25-35% tariffs. Semiconductors and pharmaceuticals have sector-specific exemptions, with Trump threatening 100% tariffs on chips unless manufacturers commit to U.S. production.

Economic Impact Analysis

Revenue Generation

The tariff regime is generating massive government revenue:

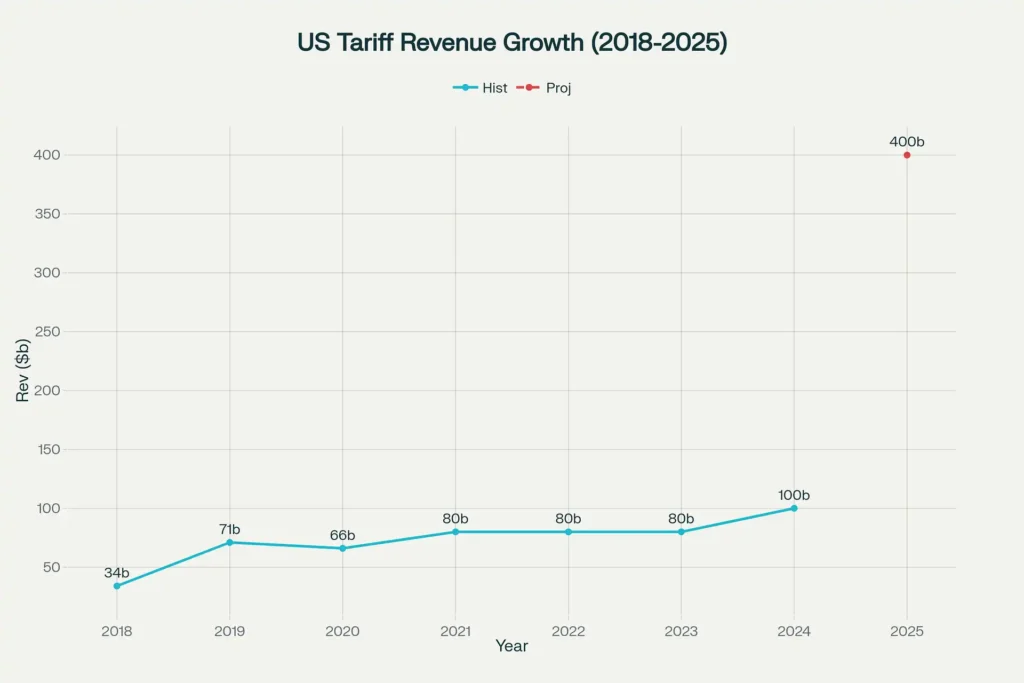

- Monthly collections: $30-50 billion, compared to $8.8 billion in July 2024

- Annual projection: $300-600 billion, representing 1.3% of GDP

- Since April 2025: Over $100 billion collected, triple the previous year’s amount

Consumer and Business Costs

Household Impact: The average American family faces an additional $2,400-2,800 in costs annually due to higher prices on imported goods. Key affected categories include:

- Clothing: 38% price increase projected

- Footwear: 40% price increase expected

- Appliances: Highest monthly increases in nearly four years

- Toys: Six-fold acceleration in price increases

Business Sentiment: Manufacturing and services sectors report declining confidence, with the ISM Prices Index reaching its highest levels since 2022. Companies are increasingly unable to absorb tariff costs, forcing price transfers to consumers.

Inflation Pressures

Inflation metrics show tariff impacts materializing:

- Overall inflation: Rose to 2.7% in June 2025 from 2.4% in May

- Core inflation: Increased to 2.9% from 2.8%

- Investment goods: Face potential 9.5% price increases under broad tariffs

- Consumer goods: Expected 2.2% price impact from universal tariffs

Global Economic Consequences

Recession Risks

International economic institutions have significantly upgraded recession probabilities:

- Global recession risk: Increased from 30% to 40%

- U.S. recession risk: Jumped from 25% to 40%

- GDP growth forecasts: Revised downward to 1.6-1.8% for 2025

The IMF warns that Trump’s tariff policies are “pushing the global economy towards a significant slowdown,” with potential GDP losses exceeding 1% globally.

Trade Partner Responses

Retaliation Measures are escalating globally:

| Country | Retaliatory Rate | Target Value | Status |

|---|---|---|---|

| China | 10-125% | All U.S. goods | 90-day truce extended |

| Canada | 25% | $20-85 billion | Active retaliation |

| European Union | 15% | Suspended | Negotiated reduction |

| Mexico | 25% | TBD | Preparing response |

China’s Response: Initially imposed 84% retaliatory tariffs, later escalated to 125%, before negotiating a temporary reduction to 10% under a 90-day framework.

Canada’s Retaliation: Implemented 25% tariffs on $20 billion worth of U.S. goods, with plans to expand coverage to $85 billion.

Supply Chain Disruptions

Automotive Sector: Particularly affected due to integrated North American supply chains. Ford CEO warned that 25% tariffs “will blow a hole in the U.S. industry that we have never seen”. Major automakers face difficult decisions about production locations and supply chain restructuring.

Semiconductor Industry: Taiwan’s TSMC received exemptions due to U.S. manufacturing commitments, while other chip producers face potential 100% tariffs.

Related Tables and Data

1. Sector-Wise Impact Analysis

| Industry Sector | Tariff Rate Range | Price Impact | Import Value (2024) | Jobs at Risk |

|---|---|---|---|---|

| Electronics | 20-30% | +8-15% | $420B | 280K |

| Consumer Goods | 15-50% | +8-25% | $320B | 520K |

| Semiconductors | 0-100% | +5-45% | $240B | 160K |

| Pharmaceuticals | 10-250% | +5-35% | $200B | 120K |

| Automotive | 15-35% | +12-18% | $180B | 450K |

2. Trade Balance Projections

| Country | 2024 Trade Deficit ($B) | Projected 2025 Deficit | Reduction Target | Tariff Rate |

|---|---|---|---|---|

| China | -382.9 | -290.0 | 25% | 30% |

| Mexico | -152.4 | -115.0 | 25% | 25% |

| Vietnam | -104.6 | -75.0 | 28% | 20% |

| Germany | -84.3 | -65.0 | 23% | 15% |

| Japan | -58.2 | -42.0 | 28% | 15% |

3. Regional Economic Impact Summary

| Region | Countries Affected | Average Tariff Rate | Trade Value at Risk ($B) | GDP Impact (%) |

|---|---|---|---|---|

| Asia-Pacific | 35 | 24% | $890 | -1.2% |

| North America | 3 | 30% | $580 | -0.8% |

| Europe | 28 | 17% | $420 | -0.6% |

| Latin America | 18 | 28% | $160 | -1.5% |

| Middle East & Africa | 12 | 35% | $120 | -0.9% |

Regional Impact Assessment

Asia-Pacific

- India: Faces 50% tariffs affecting $40 billion in exports, representing 4.8% of total exports

- China: Under negotiated 30% rate with extension talks ongoing

- Southeast Asia: Vietnam (20%), Thailand (19%), Indonesia (19%) face significant manufacturing cost pressures

Europe

- European Union: Secured 15% rate through investment commitments worth $600-750 billion

- Switzerland: Despite being a major trading partner, faces 39% tariffs

- United Kingdom: Achieved 10% rate through post-Brexit trade framework

Americas

- Brazil: Faces 50% tariffs, potentially related to political tensions over former President Bolsonaro

- Canada/Mexico: Complex dual-rate system based on USMCA compliance

Trade Deal Negotiations

Trump has concluded eight framework agreements with major trading partners, though implementation details remain unclear:

- European Union, Japan, South Korea: 15% rates with investment commitments

- United Kingdom: 10% rate

- Vietnam, Indonesia, Pakistan, Philippines: 19-20% rates

However, these agreements lack enforcement mechanisms and depend heavily on private sector compliance rather than government mandates.

Market and Financial Impacts

Stock Market Effects

- Trade war uncertainty has contributed to market volatility

- Sector-specific impacts: Manufacturing, retail, and import-dependent industries face particular pressure

- Safe haven flows: Increased demand for defensive assets amid trade tensions

Currency Effects

- Dollar strength: Supported by tariff revenues and domestic production incentives

- Trading partner currencies: Under pressure from reduced export competitiveness

- Emerging markets: Particularly vulnerable to trade disruption and capital flight risks

Future Outlook and Risks

Escalation Scenarios

Pharmaceutical Tariffs: Trump announced upcoming tariffs on pharmaceutical imports, potentially reaching 250% over time.

Semiconductor Tariffs: 100% tariffs threatened on computer chips unless manufacturers commit to U.S. production.

De-escalation Possibilities

China Negotiations: Ongoing talks for 90-day extensions of current tariff truces.

Bilateral Agreements: Potential for more comprehensive trade deals with key partners, though complex to implement.

Long-term Structural Changes

The tariff regime represents a fundamental shift toward economic nationalism, potentially reshaping global trade patterns permanently. Success depends on whether domestic production can scale to replace imports without triggering severe supply shortages or price spikes.

Trump’s 2025 tariff offensive represents the most significant trade policy shift since the 1930s, generating substantial government revenue while imposing considerable costs on consumers and businesses. With global recession risks elevated and retaliation mounting, the policy’s ultimate success will depend on its ability to achieve stated goals of trade rebalancing and domestic production growth without triggering broader economic instability.

The current trajectory suggests continued escalation unless successful negotiations produce comprehensive bilateral agreements—a challenging prospect given the complexity of modern global supply chains and the political incentives driving current policies.