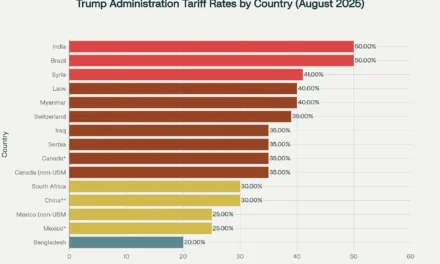

In what feels like the final chapter of weeks filled with swirling rumors and heated debates, the White House confirmed on Friday that President Donald Trump is set to impose aggressive tariffs on some of the United States’ largest trading partners. This decision marks a pivotal moment in U.S. trade policy, one that could ripple across economies worldwide.

Karoline Leavitt, the White House press secretary, announced that Trump would implement 25% tariffs on Mexico and Canada , alongside a 10% duty on China . These measures are framed as retaliation for what the administration describes as “the illegal fentanyl that they have sourced and allowed to distribute into our country.” It’s a bold stance, but one that raises questions about its effectiveness—and its consequences.

The announcement left many scratching their heads. Few specifics were provided about how these tariffs will be applied or enforced. The White House vaguely mentioned that details would be made available for public inspection by Saturday. But even without clarity, the news was enough to send shockwaves through financial markets.

Impact of Tariffs on Major U.S. Trading Partners

| Country | Tariff Rate (%) | Annual Trade Volume (USD) | Key Products Affected |

|---|---|---|---|

| Mexico | 25% | $600 billion | Cars, Electronics |

| Canada | 25% | $700 billion | Oil, Timber |

| China | 10% | $300 billion | Electronics, Apparel |

Markets React: A Rollercoaster Day for Investors

On Friday, Wall Street experienced turbulence. The Dow Jones Industrial Average plummeted more than 300 points—a drop of roughly 0.7% —while both the S&P 500 and Nasdaq Composite also turned negative. Earlier in the day, all three major benchmarks had been riding high, buoyed by optimism. But once the tariff news broke, investor confidence faltered.

“These are promises made and promises kept by the president,” Leavitt stated confidently during her briefing. Yet, for many Americans watching their retirement accounts take a hit, the phrase might feel hollow. After all, when economic uncertainty looms, it’s not just big corporations that suffer—it’s everyday people too.

Adding to the confusion, there was no mention of potential exemptions from the tariffs. Earlier reports from Reuters suggested that certain products might escape the levies entirely, or that implementation could be delayed until March 1. However, the White House quickly shot down those claims, insisting that the measures would apply broadly and immediately.

Inflation Trends Before and After Tariffs

| Month | Inflation Rate (%) | Notes |

|---|---|---|

| November | 2.4% | Pre-tariff stability |

| December | 2.6% | Slight uptick post-tariff |

| January | TBD | Expected rise due to tariffs |

Why Now? The Bigger Picture Behind the Tariffs

Collectively, the U.S. conducts nearly $1.6 trillion in annual trade with Mexico, Canada, and China. That’s an astronomical figure, underscoring just how interconnected these economies are. So why take such a drastic step now? According to the White House, the goal is twofold: to serve as bargaining chips in ongoing negotiations and to push for changes in foreign policy—particularly around immigration and drug trafficking.

Peter Navarro, a key advisor to Trump, drove home this point during a Friday interview with CNBC. He drew a striking analogy between the upcoming Super Bowl and the devastating impact of fentanyl in America.

“We’ve got the Super Bowl coming up, and eerily, the amount of people that fit in the [New Orleans] Superdome are almost exactly equal to the number of people dying every year here in America from fentanyl,” Navarro said. “And guess where that fentanyl comes from? China and Mexico. This is why we’re having these discussions.”

It’s a sobering comparison, designed to evoke emotion and urgency. But does it justify sweeping tariffs that could disrupt billions of dollars in trade? Economists aren’t so sure.

Economic Concerns: Could Tariffs Reignite Inflation?

One of the biggest fears surrounding these tariffs is their potential to reignite inflation at a time when price pressures seem to be easing. Just hours before the announcement, the Commerce Department released data showing that an inflation gauge closely watched by the Federal Reserve had risen to 2.6% in December . While the headline number suggests some upward pressure, the underlying details painted a more optimistic picture.

Still, economists warn that tariffs often lead to higher costs for businesses and consumers. When companies face increased expenses due to import taxes, they pass those costs along in the form of higher prices. And if other countries retaliate with tariffs of their own, the situation could escalate further.

Fed officials are keeping a close eye on the situation. Michelle Bowman, a member of the Federal Reserve Board, emphasized the need for caution.

“It will be very important to have a better sense of the actual policies and how they will be implemented, in addition to greater confidence about how the economy will respond,” she said.

Chicago Fed President Austan Goolsbee echoed similar sentiments in a separate interview with CNBC. He pointed out that much depends on whether these tariffs remain isolated incidents or spark a broader trade war.

“Will this be a one-off event, or will it trigger retaliatory actions?” Goolsbee asked rhetorically. “That’s the million-dollar question.”

What Does This Mean for Everyday Americans?

Let’s break it down in simpler terms. Imagine you run a small business that relies on parts imported from Mexico or Canada. Suddenly, those parts become 25% more expensive. You can either absorb the cost (cutting into your profits) or raise your prices (passing the burden onto your customers). Neither option is ideal.

Now imagine you’re a consumer shopping for electronics, clothing, or furniture—many of which come from China. With a 10% tariff added to those goods, you’ll likely see prices creep up over time. For families already stretched thin, even small increases can add up quickly.

And then there’s the bigger issue of trust. When governments impose sudden, sweeping changes like this, it creates uncertainty. Businesses hesitate to invest. Consumers hold off on major purchases. And that hesitation can slow down economic growth.

Looking Ahead: Questions Remain

While the White House frames these tariffs as necessary steps to address critical issues like drug trafficking and immigration, critics argue that the approach may do more harm than good. Will Mexico and Canada agree to stricter border controls? Will China crack down on fentanyl production? Or will these tariffs simply strain relationships and hurt American workers in the process?

For now, answers remain elusive. One thing is clear, though: the stakes are incredibly high. As the details unfold, the world will be watching closely to see whether this gamble pays off—or backfires spectacularly.